The truth about private equity (and why Magic Touch isn’t selling out).

Is your favorite “family owned” air conditioning company not actually family owned anymore? Do you know if your trusted HVAC service provider is really owned by a private equity firm? If you live in the Phoenix area you might be surprised to learn just how many companies are no longer owned by the families they used to be.

TL;DR (Too Long, Didn’t Read) Quick Summary

Wondering if your “family-owned” AC company is really family-owned? Here’s the short version:

- 🏦 Private equity (PE) = Wall Street investors who buy companies, grow them fast, then sell them in 3–7 years.

- ❄️ HVAC is a big target because everyone needs AC in Phoenix, and there are thousands of small family businesses to scoop up.

- 📉 We’ve seen this before in the 90s — it failed, companies folded, and warranties vanished.

- 🕵️♂️ Many Phoenix companies that look family-owned today are actually PE-owned, using old names in ads to keep up appearances.

- 👷♂️ The focus shifts from craftsmanship to sales quotas, and techs get burned out and leave.

- 🔧 If the company is sold or rebranded, your labor warranty may disappear.

- ✅ Magic Touch Mechanical? Still family-owned. Still independent. Not for sale.

1) What is Private Equity (PE)?

Private equity is investor money. PE firms buy businesses (like HVAC companies), push them to grow quickly, and then flip them in 3–7 years for a profit. Think of it like house-flipping — but instead of houses, they’re flipping your service company.

2) Why does PE love HVAC?

Because AC is essential in Phoenix. Everyone needs it, replacements are predictable, and there are thousands of small companies to buy and merge. It’s reliable cash flow, which investors love.

HVAC companies are also easy to expand into other services. Once the structure is in place, many PE firms add plumbing, electrical, roofing, solar, pest control, or even audio-visual installations — creating more ways to monetize every household.

3) Why did so many family-owned firms sell after Covid?

Covid burned a lot of owners out. Between supply chain chaos, staffing struggles, regulatory changes, and stress, many took the “big check” from PE buyers and walked away.

The pandemic also created a sales surge. With more people working from home and kids learning online, homeowners invested in upgrades, including new AC systems. All those installs made companies look stronger than ever on paper — exactly what investors like to see. For owners near retirement, there was never a better time to sell.

4) Haven’t we seen this before? (Yes — in the 90s)

In the 1990s, giant corporations tried to roll up HVAC companies nationwide. It ended badly. Some went bankrupt, warranties were lost, and a few owners even bought back their companies to save them.

This round looks quieter — but the investors are just as aggressive.

5) Do PE-owned companies ever fail?

Yes. When they pile on debt or can’t keep technicians, things collapse. When that happens, homeowners can lose their labor warranties, and employees lose jobs.

In March of this year, a major PE-backed HVAC company filed for Chapter 11 bankruptcy. The reasons for failure included many we’ve already discussed — plus the company’s original CEO resigning just eight months prior.

Will they all eventually fail?

No — that seems highly unlikely. Many of the largest PE firms are well-structured, highly capitalized, and experts in their field. That includes several in HVAC. In fact, it’s fair to predict that quite a few will continue to grow and change some markets forever.

Example: When PE Works in HVAC

There are PE-backed HVAC groups today that are growing aggressively and successfully. These are usually the firms that:

- Invest heavily in training – creating academies or partnering with trade schools to attract and keep skilled technicians.

- Leverage national buying power – securing better equipment pricing and sometimes passing savings on to customers.

- Standardize processes – using advanced dispatch software, financing programs, and customer service platforms.

- Retain leadership – keeping original owners or seasoned executives in place so industry knowledge drives decisions.

The result is a company that looks bigger, runs smoother, and has resources smaller shops might not.

6) What’s a “tuck-in”?

This is when a bigger company swallows a smaller one and keeps the trucks and ads looking “local.” You think you’re calling Joe’s Heating, but really you’re talking to a giant call center that may also answer for a dozen other “Joes” — sometimes not even in this state (or this country).

7) Phoenix reality check

In Phoenix, many of the companies you see on billboards and TV are no longer family-owned — even though the old names are still plastered on trucks and ads. The original families often have nothing to do with those businesses anymore, but contracts keep them from saying so.

And it’s not just the big names — even medium and smaller shops are being quietly bought and tucked in.

I started Magic Touch Mechanical in Mesa back in January 1997. After 28 years in this industry, serving on boards, councils, and advisory groups, I know most of the “old heads” personally. The vast majority of them have now sold to private equity. I’m happy for them, but I’m not convinced it’s good for the industry or the community.

8) The technician problem

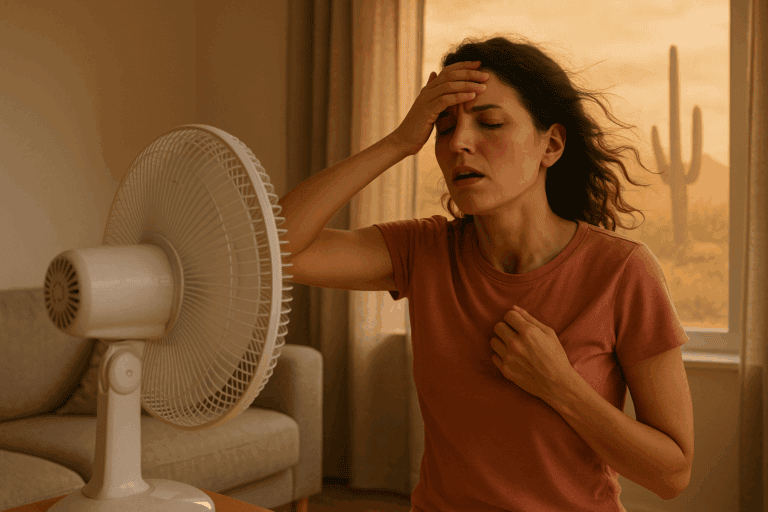

When investors push a sales-first culture, technicians get burned out. The best ones don’t want to be salespeople; they want to fix things. So they leave. Homeowners notice the revolving door.

Some of those techs land on their feet with companies like Magic Touch. Others leave the industry entirely. Some take their shot as entrepreneurs — a few succeed, but many don’t. Competing with massive PE-backed groups is hard even for established companies, let alone a startup.

The bigger risk is what happens when those experienced techs leave: PE groups often fill the gap with under-qualified hires, train them to “sell-sell-sell,” and put them in a technician’s uniform. I probably don’t need to explain why that’s bad for customers.

9) Why PE isn’t always good for you

Let me be clear: PE isn’t evil. Capitalism is the American way. But PE is built to serve investors — not homeowners. That can mean:

- Higher prices once a few large monopolies take hold

- Warranties that may prove worthless if companies are resold

- More turnover in the people servicing your home

- Under-qualified, commission-driven workers touching your equipment

- Less money staying local in Mesa, Gilbert, Chandler, Tempe, Scottsdale, and Phoenix

What That Means for Homeowners

- ⚠️ Rapid consolidation → the name on the truck may not match the owner.

- ⚠️ Short-term focus → investors aim for profit in 3–7 years, not lifelong service.

- ⚠️ Sales-first culture → pressure on techs to sell vs. fix.

- ⚠️ Warranties at risk if the company is absorbed, renamed, or resold.

10) My story (why I never sold out)

A few years ago, an acquaintance of mine — one of the biggest players in HVAC private equity — asked if I’d ever sell. I told him I never even took a meeting. He said Magic Touch was exactly the kind of company PE firms love, and that I could retire tomorrow.

But here’s why I didn’t — and won’t:

- I’m not done building this business. I still love it (most days).

- I’ve wanted to be a tradesman since I was a kid — I don’t want to retire and wouldn’t know what to do with myself if I did.

- I don’t believe the PE model serves my team or my customers.

- This company was built by my employees and customers — some who’ve been with us since 1997.

PE firms still call us — every single day. But we’re not for sale.

We’re not for sale.

✅ Family-owned & operated in Mesa since 1997

✅ Serving Phoenix, Gilbert, Chandler, Scottsdale & Queen Creek

✅ Focused on long-term relationships, not short-term profits

11) Is PE Always Bad? No — Some Do Very Well.

It would be unfair to paint all private equity firms with the same brush. The truth is, many are well-funded, well-structured, and led by experienced operators. These groups bring resources smaller companies could never access alone: advanced software, marketing muscle, national buying power, and professional management.

That’s why some PE-backed HVAC companies will thrive — and likely reshape parts of our industry forever. Some markets may look very different 10 years from now because of how these groups expand and innovate.

But homeowners should still understand: while some PE companies are built to last, their ultimate loyalty is to investors — not to you or your community. That’s not “bad,” it’s just a different business model.

12) An Example of PE Changing the Game (Outside HVAC)

In the early 2000s, PE firms invested heavily in electronic medical records (EMR) and healthcare IT. At the time, most doctors still used paper charts. The firms:

- Poured in capital to build better software

- Consolidated small providers into national players

- Scaled up training & support so hospitals could adopt faster

- Accelerated innovation like telehealth and cloud storage

By the mid-2010s, EMR adoption in the U.S. went from under 20% to nearly universal — largely because PE-backed firms had the capital to push it through.

Why it worked there:

- High barriers to entry (complex & regulated)

- Massive capital requirements (beyond what founders could raise alone)

- Clear national benefit (digital records improved efficiency and patient care)

In industries like that, PE can accelerate adoption and create real benefits.

How can you tell if a company is PE-owned?

- Multiple brands under the same phone number

- Suddenly offers plumbing, electrical, or solar “overnight”

- Website says “family values since 19XX” but doesn’t name current owners

- Frequent name changes or “powered by” fine print

- Techs who act more like salespeople than tradespeople

Homeowner Checklist Before You Hire

| Question | Why it matters |

|---|---|

| Are they family-owned or PE-owned? | PE ownership may mean investors, not locals. |

| Who honors my labor warranty if they sell? | If the company disappears, your warranty might too. |

| Do they have employees or subcontractors? | Employees = more accountability. |

| How long have the techs been there? | Long-tenured techs = better service & less sales pressure. |

| Where’s the office/call center? | Local = faster response and people who know the Valley. |

Phoenix Homeowner FAQ

Q: Are there AC companies near me that are not PE-owned?

A: Yes. Magic Touch Mechanical is family-owned and independent in Mesa since 1997. We’re not PE-owned — and we’re not selling.

Q: Why does PE buy HVAC companies?

A: Because HVAC is essential, profitable, and fragmented — thousands of small businesses make it easy to buy and merge.

Q: What’s a “tuck-in”?

A: When a PE-owned company absorbs a smaller one, often keeping the old name in ads to look family-owned.

Q: What’s the risk if my HVAC company is PE-owned?

A: You could lose your labor warranty, see more tech turnover, and pay higher prices.

Q: How do I check if my AC company is PE-owned?

A: Ask directly, look for multiple brands under one call center, check for vague ownership language online, or search press releases.

Q: Is Magic Touch Mechanical owned by PE?

A: No. Magic Touch Mechanical is 100% locally owned and family operated in Mesa, Arizona since 1997.

Now, in “Investor Language” (for fun)

Okay, if you’ve made it this far, here’s the Wall Street version — the kind investors would explain over martinis:

Private equity firms look for industries with:

- Essential demand (you can’t live without AC in Phoenix)

- Predictable cycles (systems wear out every 10–15 years)

- Fragmentation (thousands of small shops to buy up)

- Stable cash flow (repairs, maintenance, replacements)

In the past, investors would’ve put that money in the stock market, bonds, or real estate. But HVAC companies are “sticky” — recession-resistant, predictable, and profitable.

In plain English: AC companies became Wall Street’s new favorite stock.

📊 Why Investors Love HVAC (and Why Homeowners Should Care)

| Investor Priority | Why HVAC Checks the Box |

|---|---|

| Essential demand | You can’t live in Phoenix without AC. Reliable revenue even in recessions. |

| Predictable cycles | Units last 10–15 years → guaranteed replacements & steady service calls. |

| Fragmented industry | Thousands of family-owned shops = easy to buy and merge. |

| Stable cash flow | Maintenance agreements & seasonal demand create recurring revenue. |

| Recession-resistant | People cut vacations, not AC repairs. |

The Bottom Line

- Many Phoenix HVAC companies that look family-owned aren’t anymore.

- Private equity means investors come first, not homeowners.

- At Magic Touch Mechanical, we’ve been independent since 1997 — and plan to keep it that way.

👉 If you want a truly local HVAC company in Phoenix, Mesa, Gilbert, Chandler, Scottsdale, or Queen Creek — we’d love to earn your trust.

Prefer video? Subscribe to our YouTube channel for more like this.